Three Insights From the 2021 State of Flight Training Report

Several clear trends and insights emerged from this year's State of Flight Training Report. We will be exploring many of these in detail over the coming months. I've outlined three here to give you some context and material to inform your thinking for 2021.

Trend 1:

The Impacts of COVID-19 on Flight Training Providers Varied

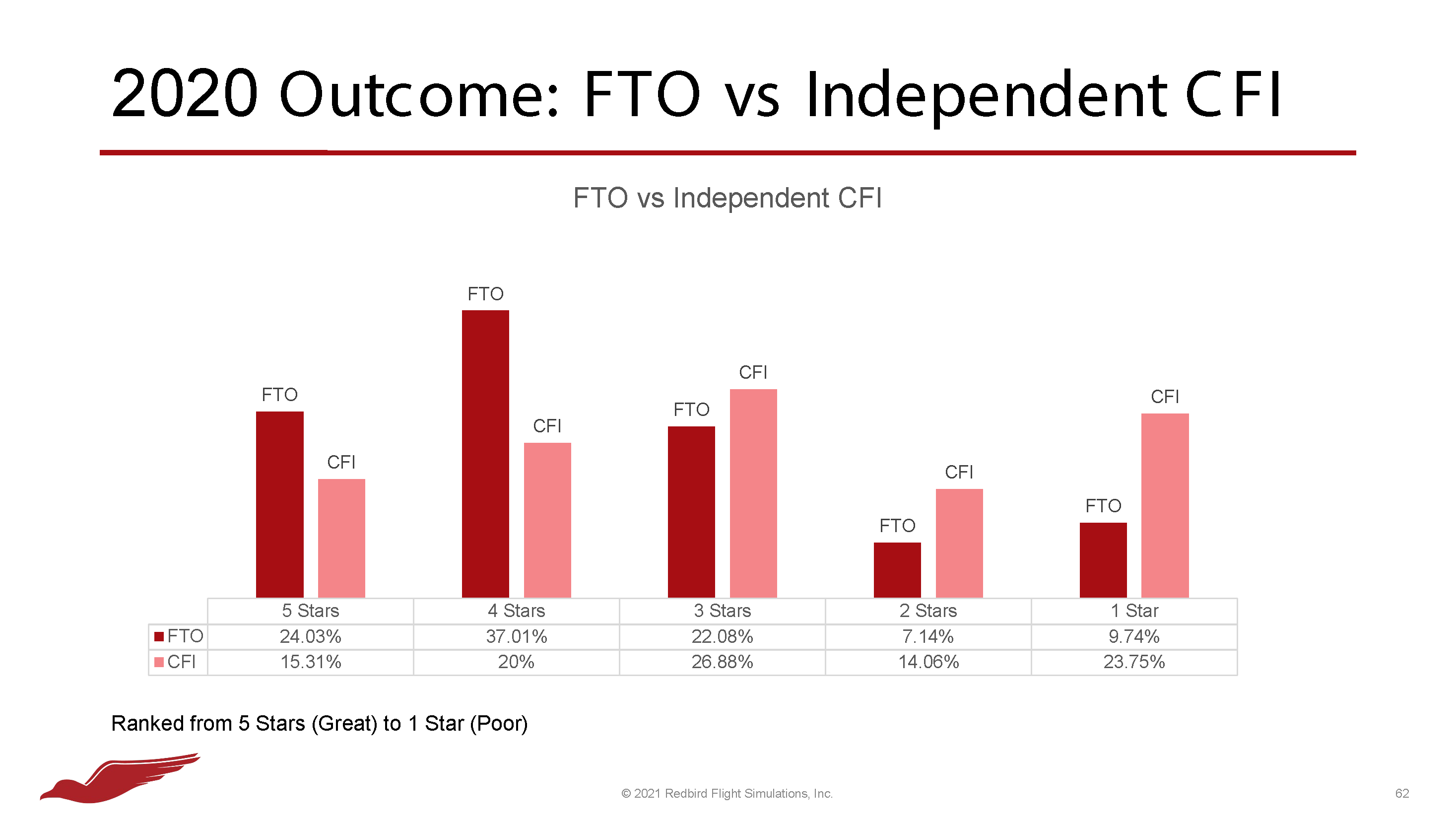

Like the rest of the world, the flight training industry was impacted massively by COVID-19 and the resulting lockdowns and restrictions. However, Independent Certified Flight Instructors (I-CFI) disproportionately felt that impact. In broad terms, most Flight Training Organizations (FTO) weathered the storm reasonably well, and some even benefitted from the increased disposable income and free time of consumers. Conversely, I-CFIs faced immense challenges and lacked the infrastructure and industry support to succeed during the pandemic.

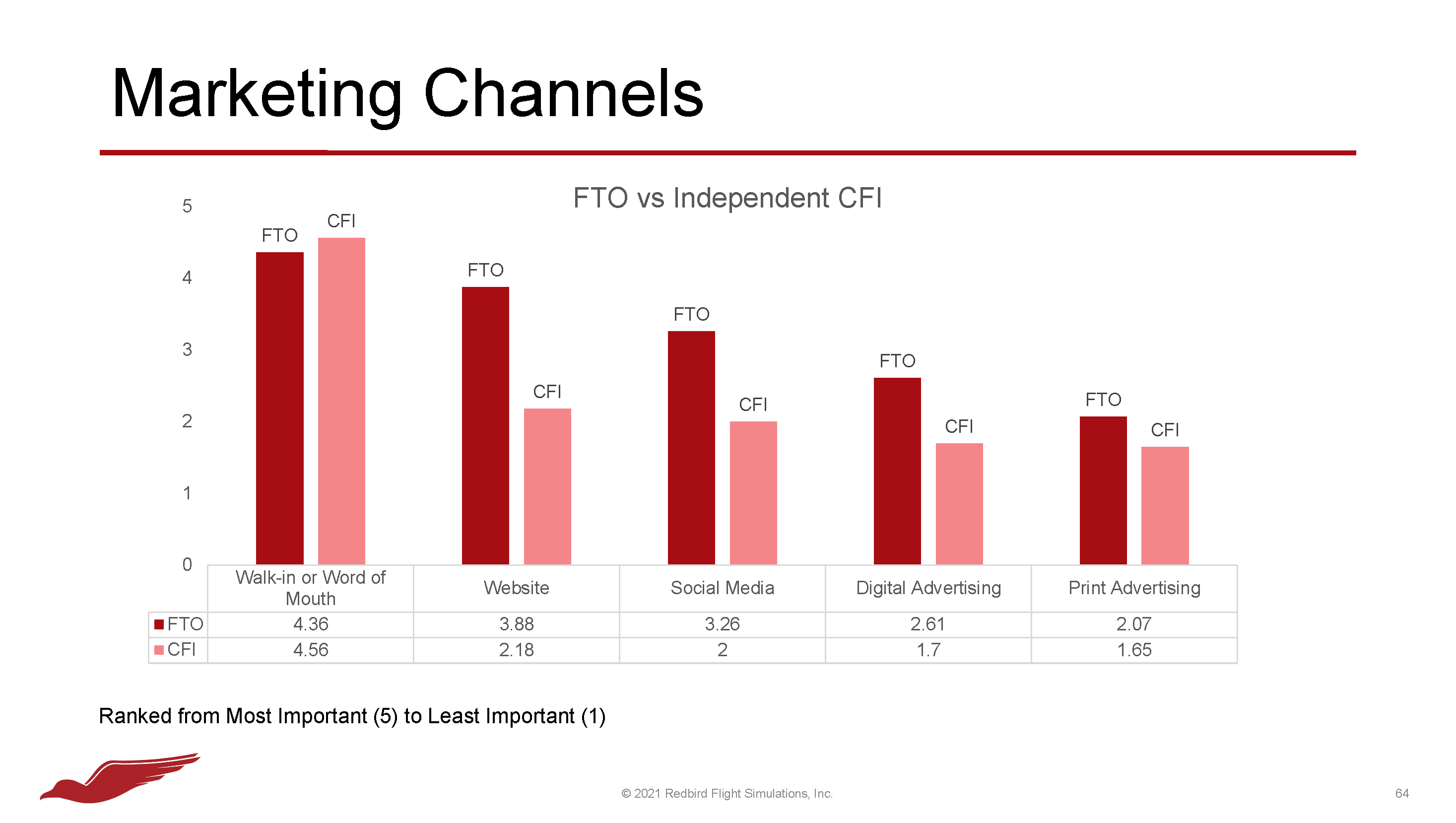

These drastically lower performance ratings are likely due to several factors. However, the reliance of Independent Flight Instructors on word-of-mouth and walk-in marketing for new business stands out. In a world of lockdowns, a more sophisticated digital marketing model is a requirement. In general, FTOs ranked their websites and social media channels as far more impactful than I-CFIs did. As the consumer base for flight training shifts younger and more digitally savvy, this area will continue to factor into who wins and loses in the industry.

Thankfully, building a modern website and social media presence has never been easier or cheaper. With tools like Squarespace and Wix, more I-CFIs can establish a basic digital presence. This is also an area where industry groups can provide much-needed knowledge and support. It is time for the industry organizations that care about a healthy and robust cohort of I-CFIs to communicate the value of digital marketing, and most critically, provide tools to help.

This shift to a digital-first marketing approach does not only apply to I-CFIs. All training providers should continue or accelerate their efforts to reach consumers where they are most active: online.

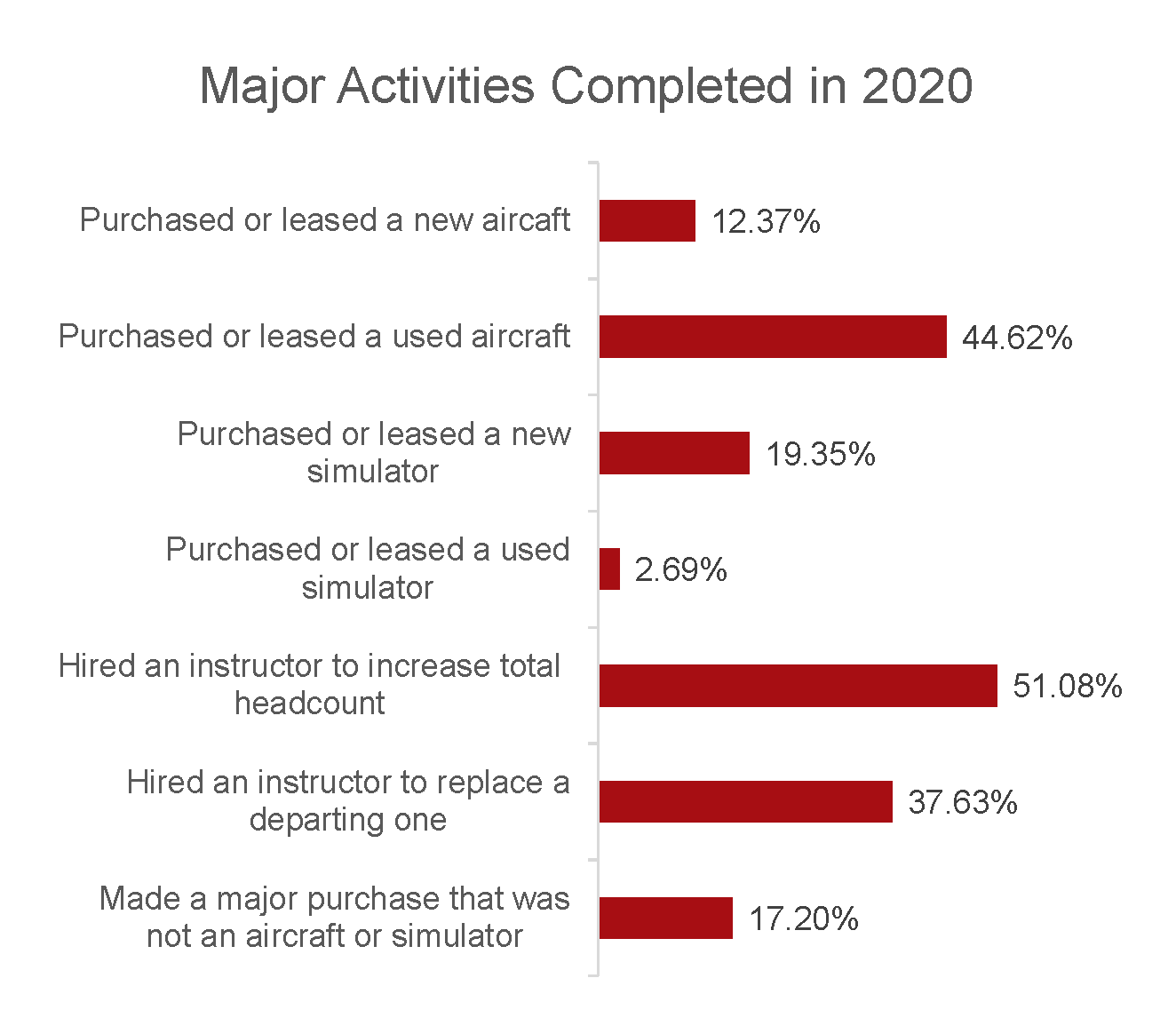

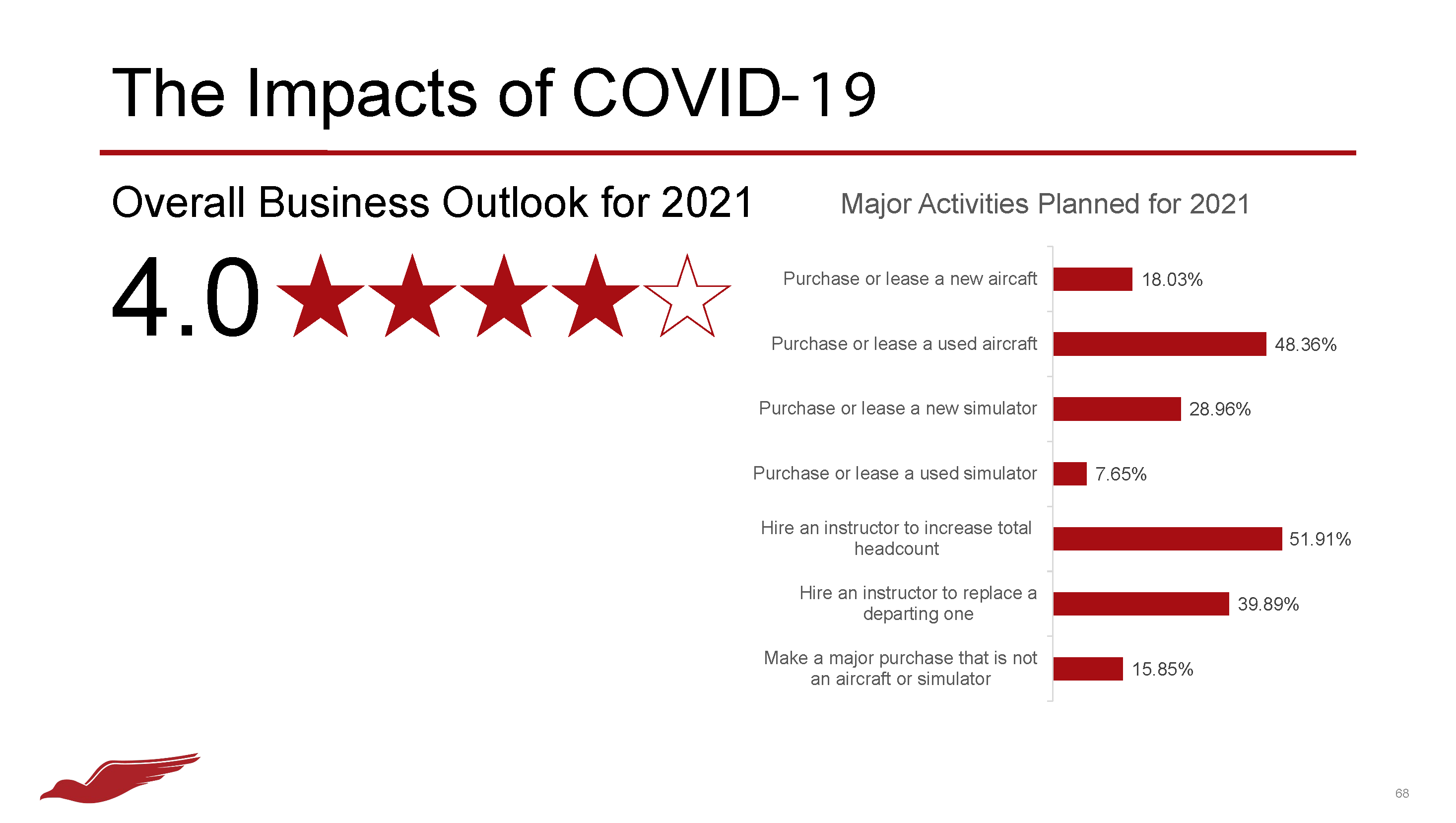

FTOs leveraged their relative success this year to add to their aircraft fleet, hire instructors, and expand their simulator offerings. Over 50% of FTOs made a major purchase, lease, or increased instructor headcount in 2020.

As you would expect, the results flight training providers achieved in 2020 greatly influence their plans for 2021. Consequently, FTOs are generally far more optimistic about this year, and they plan to continue their growth. Like many industries, Flight Training is at a critical juncture. The larger organizations strengthened in 2020, and the smaller ones weakened. Without substantial changes, this trend is likely to continue in 2021, and many small and independent providers will be acquired or go out of business.

Trend 2:

Students and Instructors Disagree About the Value of Simulation

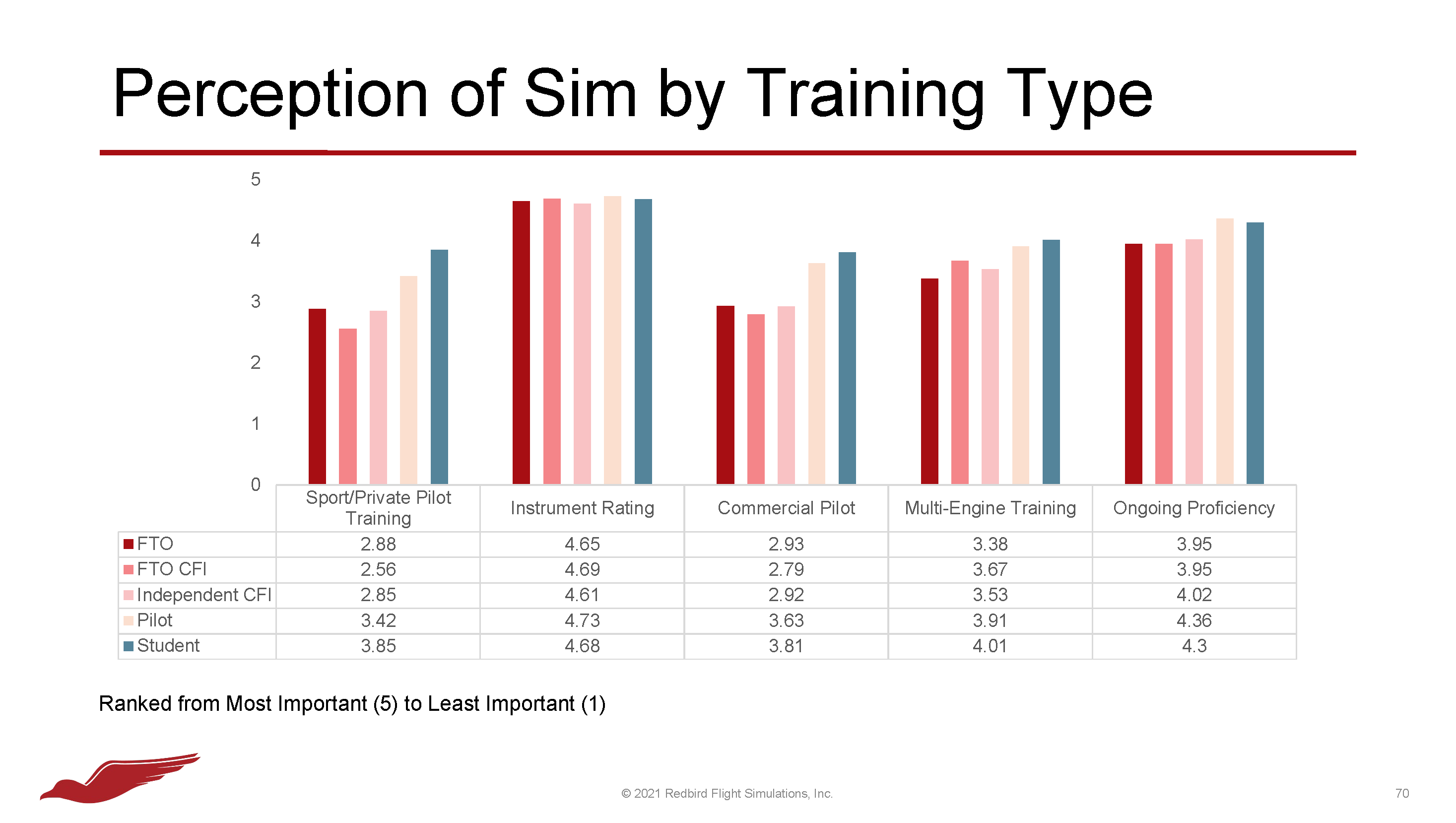

There is a common line of thinking you hear in flight instructor circles: “This sim is great and all, but people just want to get in the airplane. It’s why they are learning to fly.” This idea makes some sense at face value, and instructors reference it frequently to justify lower simulator utilization rates.However, the truth is likely more nuanced. Based on the data from this year’s survey, Students and Pilots tend to value training time in a simulator more than instructors.

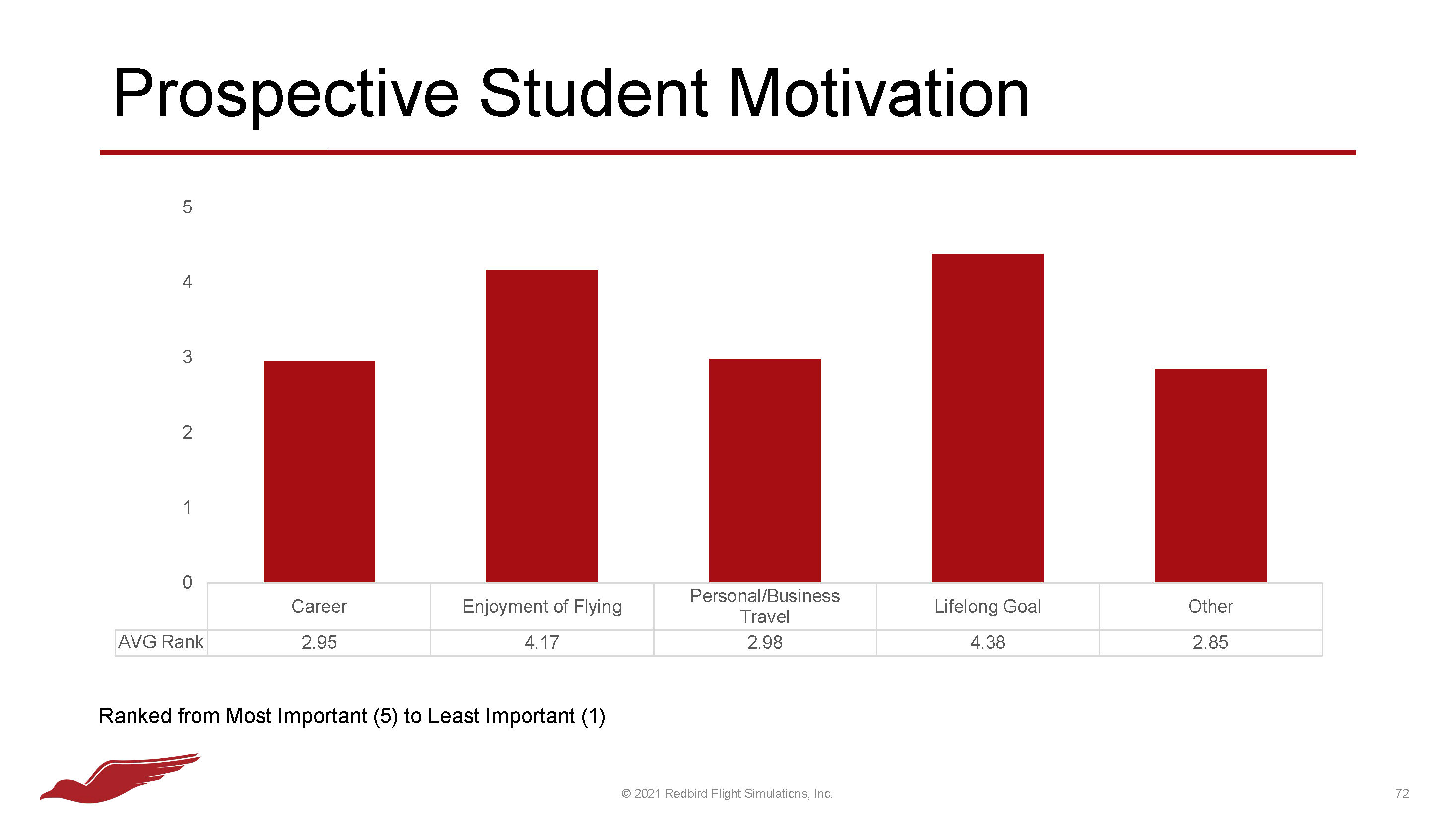

Students and Pilots who are actively training are not spending their time and money for pleasure flights; they are working to achieve a goal. They innately recognize the value of simulation and appreciate its potential to lower the cost and decrease the time to achieve their goal. It is true that most Students and Pilots rate “Enjoyment of Flight” as their primary motivating factor for being a pilot, but their motivation during training is not “to just get in the airplane.” They want to achieve their goal, and they are willing to use tools to help them do it as quickly and efficiently as possible.

Perhaps flight instructors who doubt the value of simulation or their students’ willingness to use it should reevaluate their reasoning and remember that the goal of flight training is not to fly. The goal is to earn a certificate, rating, or endorsement and become a better pilot.

Trend 3:

Not Everyone Wants to Be a Pilot

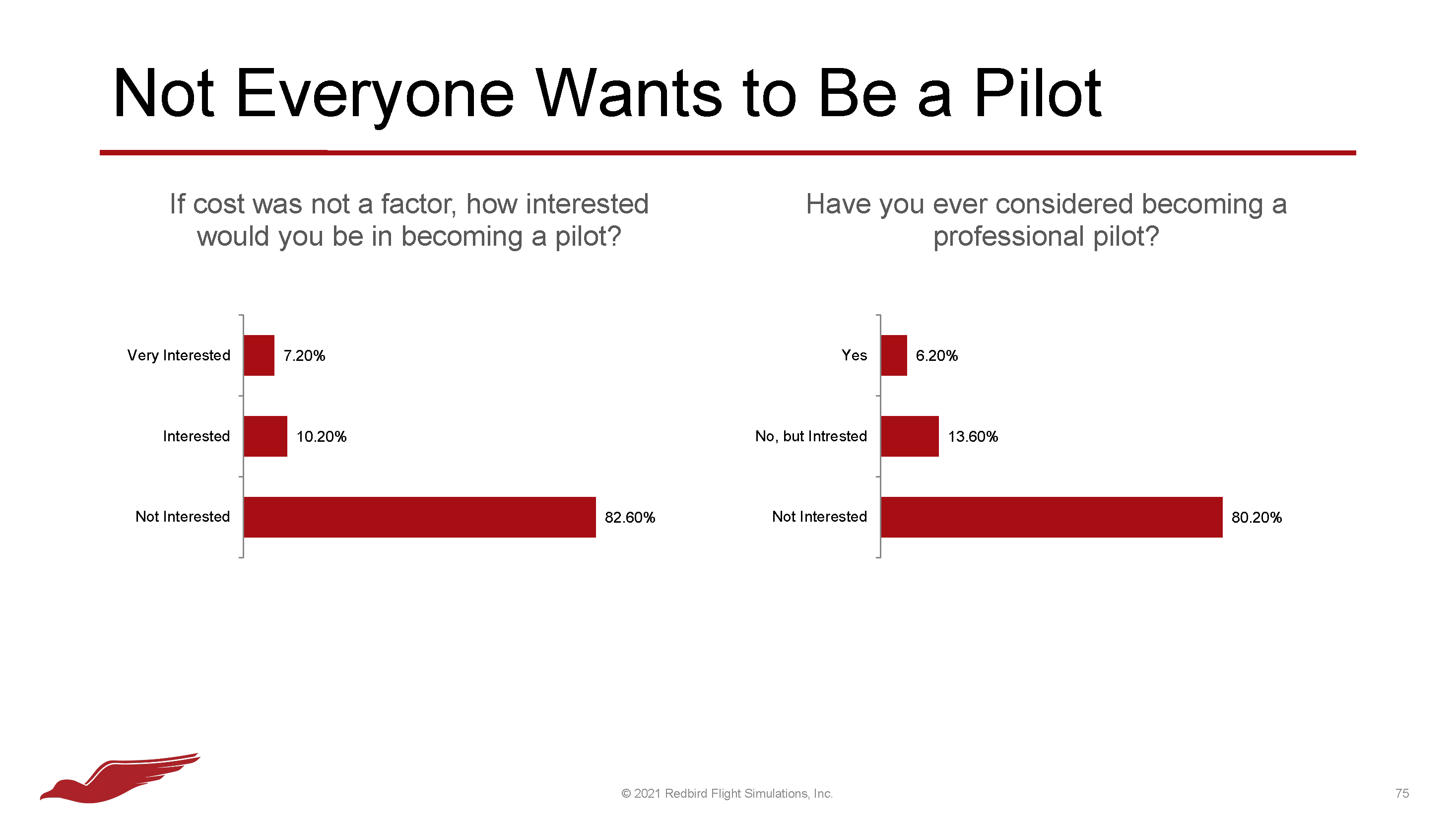

If you’re involved in the flight training industry you likely have made some painful sacrifices and choices. Learning to fly is not cheap, and it is notoriously time-consuming. Pursuing a career in aviation is equivalent to becoming an attorney in both dollars and years. Many professional pilots and instructors have education debts that would make a financial planner blush. If you are in this industry, you love flying. It is the only explanation for why you would put yourself through the pain. Resultantly, you may find it hard to understand that not everyone wants to be a pilot. In fact, approximately 80% of the general public in the United States has no interest in becoming a pilot, even if cost was not a factor.

This statistic is significant for a few reasons. First, it defines the total addressable market size of our industry. At first glance, this limit may seem like a negative, but the data show a total addressable market of over 40,000,000 eligible and interested potential pilots. That is 60 times the current number of pilots in the US. The industry has a lot of room to grow before it hits a market limit.

Next, the industry needs to recognize that its customers have influential people in their lives who just don’t get it. These people have no interest in aviation and cannot understand why their spouse, child, or friend wastes time and money flying around in small, unsafe airplanes. Training providers, instructors, and industry groups need to provide support and materials to help customers justify and explain the benefits, costs, and safety of general aviation. Aircraft OEMs understand this dynamic. Cirrus’s recent domination of the Single-Engine Piston market is in no small part due to its innovative CAPS parachute and the soothing effects it has on spouses. The flight training industry needs to reduce the friction its customers face at home by putting more energy into similar efforts.

Share this

You May Also Like

These Related Articles

How to Overcome the Challenges of Remote Flight Instruction

Is Online Ground School Right for You?